The FT reckons the Tories are eyeing up a shares sale of some of some of the UKFI Ltd portfolio, this follows Myners on the weekend claiming to Adam Boulton that the taxpayer was sitting on a little nest egg investment in the banking system. Perhaps, if you ignore the financial black hole that is Northern Crock.

The FT reckons the Tories are eyeing up a shares sale of some of some of the UKFI Ltd portfolio, this follows Myners on the weekend claiming to Adam Boulton that the taxpayer was sitting on a little nest egg investment in the banking system. Perhaps, if you ignore the financial black hole that is Northern Crock.

Don’t get too excited. Moodys has just released research suggesting we will see further losses of around £130 billion from the loan books and securities portfolios of rated UK financial institutions. The UK economy is nowhere near out of the hole yet:

- We are in a fifth consecutive quarter of recession.

- Real GDP fell 0.8% quarter-on-quarter.

- Output has fallen 5.6% year-on-year, the worst since records began in 1955.

- The Bank of England base rate at 0.5%, is the lowest rate since the central bank was founded in 1694.

- The Old Lady has eased £125 billion of new electronic money into the economy to create a false market in government gilts.

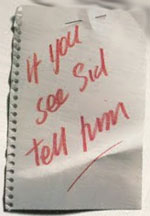

- Nevertheless, the efforts thus far have met with little success: net bank lending to individuals fell to a fresh record low in June, net lending to U.K. businesses has slipped into negative territory in recent months, as repayments exceeded new loans. Sid is saving to pay down debt – unlike Gordon.

Guido’s advice to Sid: buy a little gold for insurance, invest in inflation linked securities and neither the great British pound or the U.S. dollar are great places to be. Pop one of Gordon’s happy pills, we ain’t out of it yet…